Essentials Of Strategic Management Gamble Pdf Download

04.09.2019

79 - Comments

Essentials Of Strategic Management Gamble Pdf Download Rating: 8,7/10 8798 reviews

This is completed downloadable of Essentials of Strategic Management: The Quest for Competitive Advantage 5th edition by John E. Gamble, Margaret A. Peteraf, Arthur A. Solution Manual.

The Quest for Competitive Advantage

Author: John E. Gamble

Publisher:

ISBN:

Category: Business & Economics

Page: 440

View: 301

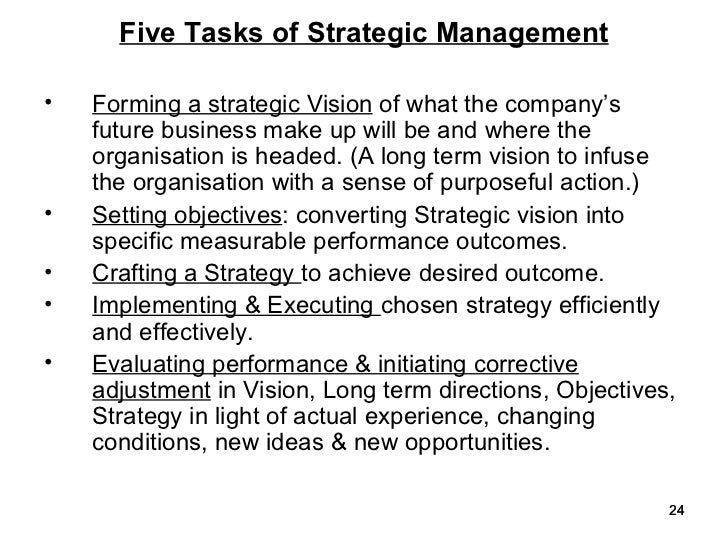

Essentials of Strategic Management presents a conceptually strong treatment of strategic management principles and analytic approaches that features straight-to-the-point discussions, timely examples, and a writing style that captures the interest of students. The Fourth Edition of Essentials of Strategic Management is very much in step with the best academic thinking and contemporary management practice. The chapter content continues to be solidly main-stream and balanced, mirroring both the penetrating insight of academic thought and the pragmatism of real-world strategic management. The text serves as the theoretical foundation of a teaching approach incorporating a business strategy simulation.Essentials Of Strategic Management Gamble Pdf Download Free

'Essentials of Strategic Management' responds head-on to the growing requests by business faculty for a concisely-written strategic management text that's robust and theory-driven and supported with a compelling collection of cases.

Sample questions asked in the 5th edition of Essentials of Strategic Management:

Is your company’s strategy ethical? Why or why not? Is there anything that your company has done or is now doing that could legitimately be considered as “shady” by your competitors?

Go to www.google.com/green/ and read the company’s latest sustainability initiatives. What are Google’s key policies and actions that help it reduce its environmental footprint? How does the company integrate the idea of creating a 'better web that’s better for the environment' with its strategies for crating value and profits? How doe these initiatives help build competitive advantage?

Using the financial ratios provided in the Appendix and the financial statement information for Costco Wholesale Corporation, Inc., below, calculate the following ratios for Costco for both 2013 and 2014. 1. Gross profit margin 2. Operating profit margin 3. Net profit margin 4. Times interest earned coverage 5. Return on shareholders’ equity 6. Return on assets 7. Debt-to-equity ratio 8. Days of inventory 9. Inventory turnover ratio 10. Average collection period Based on these ratios, did Costco’s financial performance improve, weaken, or remain about the same from 2013 to 2014? Source: Costco Wholesale Corporation, 2014 10-K.

The National Restaurant Association publishes an annual industry factbook that can be found at www.restaurant.org . Based on information in the latest report, does it appear that macro-environmental factors and the economic characteristics of the industry will present industry participants with attractive opportunities for growth and profitability? Explain.

The questions below are for simulation participants whose companies operate in an international market arena. If your company competes only in a single country, then skip the questions in this section. To what extent, if any, have you and your co-managers adapted your company’s strategy to take shifting exchange rates into account? In other words, have you undertaken any actions to try to minimize the impact of adverse shifts in exchange rates?

What specific resources and capabilities does your company possess that would make it attractive to diversify into related businesses? Indicate what kinds of strategic fit benefits could be captured by transferring these resources and competitive capabilities to newly acquired related businesses.

Sample questions asked in the 5th edition of Essentials of Strategic Management:

Is your company’s strategy ethical? Why or why not? Is there anything that your company has done or is now doing that could legitimately be considered as “shady” by your competitors?

Go to www.google.com/green/ and read the company’s latest sustainability initiatives. What are Google’s key policies and actions that help it reduce its environmental footprint? How does the company integrate the idea of creating a 'better web that’s better for the environment' with its strategies for crating value and profits? How doe these initiatives help build competitive advantage?

Using the financial ratios provided in the Appendix and the financial statement information for Costco Wholesale Corporation, Inc., below, calculate the following ratios for Costco for both 2013 and 2014. 1. Gross profit margin 2. Operating profit margin 3. Net profit margin 4. Times interest earned coverage 5. Return on shareholders’ equity 6. Return on assets 7. Debt-to-equity ratio 8. Days of inventory 9. Inventory turnover ratio 10. Average collection period Based on these ratios, did Costco’s financial performance improve, weaken, or remain about the same from 2013 to 2014? Source: Costco Wholesale Corporation, 2014 10-K.

The National Restaurant Association publishes an annual industry factbook that can be found at www.restaurant.org . Based on information in the latest report, does it appear that macro-environmental factors and the economic characteristics of the industry will present industry participants with attractive opportunities for growth and profitability? Explain.

The questions below are for simulation participants whose companies operate in an international market arena. If your company competes only in a single country, then skip the questions in this section. To what extent, if any, have you and your co-managers adapted your company’s strategy to take shifting exchange rates into account? In other words, have you undertaken any actions to try to minimize the impact of adverse shifts in exchange rates?

What specific resources and capabilities does your company possess that would make it attractive to diversify into related businesses? Indicate what kinds of strategic fit benefits could be captured by transferring these resources and competitive capabilities to newly acquired related businesses.